An employee receives several types of allowances over and above their regular salary. Medical allowance, House Rent Allowance, and Leave Travel Allowance (LTA) are a few examples of such allowances. The allowances are part of the employee’s CTC. The employee can claim tax exemption for the income through these allowances. Leave Travel Allowance is a helpful tax-saving option for employees.

Corporate travel comprises essential and non-essential travel. Traveling to a holiday destination is a non-essential business trip. Many companies provide Leave Travel Allowance to help employees visit tourist destinations or hometowns. An employee may travel alone or with family to enjoy the benefits of LTA. Corporate travel managers can integrate the company’s LTA rules into the travel policy for effective implementation. Keep reading to know how to calculate travel allowance for tax exemption.

Understanding Leave Travel Allowance

The Leave Travel Allowance or Leave Travel Concession is the facility by the employer to enable employees on leave to travel from their place of work to any destination within the country. The name Leave Travel Allowance implies the employee should be on leave during the period of traveling to claim the allowance.

Employers use the quantum of LTA while structuring the annual package or the CTC. It enables the employee to avail of the tax benefits under relevant sections of the Income Tax Act. The corporate travel manager needs awareness of the mandatory requirements to help employees claim tax exemption.

The deductions for tax exemptions cover travel expenses for the round trip. These do not apply to other expenses like boarding, sightseeing, or shopping. One should ensure the traveling expenses do not exceed the Leave Travel Allowance. If the expenditure for traveling is less than the LTA amount, then the remaining amount becomes part of the employee’s taxable income.

Conditions for claiming LTA

Leave Travel Allowance has two obvious requirements: leave and travel. The employee must be on leave during the travel as the aim is to facilitate a break from the official work. Benefits of the Leave Travel Allowance may not be available to all employees in the organization.

The employer has the prerogative to provide the facility to employees by considering employee grades and pay scales. Confirming the pay structure is advisable to know whether the employee is eligible for the Leave Travel Concession. Travel managers should inform the date to claim LTA TO all eligible employees to help them plan travel and submit relevant documents to the finance department.

One can claim the economy fare of an LCC (Low-cost carrier) if traveling by air.

LTA also applies to rail journeys. First class AC fare for the shortest route of train travel is permissible to avail tax exemption through LTA.

One may also claim tax exemption for travel by other modes like road transport. The expenses should be equivalent to or lesser than the first class AC fare of the train.

Though travel expenses by all modes of travel are acceptable for tax benefits, the employee must produce valid journey tickets or receipts. A spouse, children, siblings, and dependent parents can accompany the employee for LTA travel. The tax exemption is only available for two children.

Factors to consider for LTA calculation

One must find out when to claim Leave Travel Assistance before knowing how to calculate Leave Travel Allowance in salary. Tax breaks for LTA travel expenses are available twice in the four years’ block to eligible employees. The system of block years began in 1986. The current block is 2022 -2025.

The employee may claim the tax exemption in the next block if they cannot undertake travel with leave during the current block as the tax break carries forward to the next block. The employee who did not avail of tax exemption during the block of 2018-2021 is eligible to claim the same by availing of LTA in the current block. They are also eligible for claiming tax breaks for the current block of 2022-2025.

Let us understand how to calculate travel allowance to avail tax benefits. An employee can only claim tax-benefits for actual travel expenses by the shortest route. The employee qualifies to claim the entire LTA amount for tax benefit if the actual travel expenses are the same as the LTA amount.

One can claim the amount of Rs 5000/- by submitting documents to prove travel expenses if the LTA amount as per CTC is Rs 5000/-. Travel expenses of Rs 4000/- will add Rs 1000/- to the total taxable income as the employee can only claim tax benefits for Rs 4000/-.

Employees opting for the new tax regime are not eligible to claim a tax break.

Suggested Read: Are Travel Expenses Tax Deductible Or Not?

Automated travel management solution

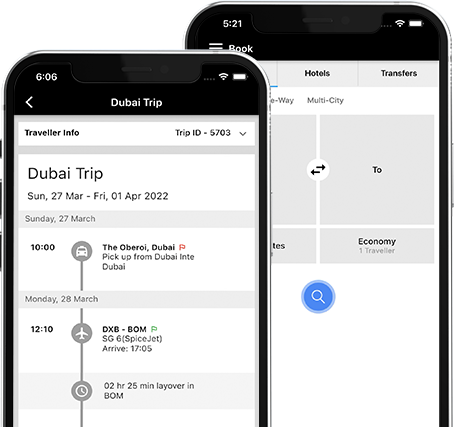

Corporate travel managers should use an automated platform for travel management to help employees get the best deals on travel and hotel bookings if they are going on vacation. It will help them get to travel and hotel bookings without hassles. The automated travel booking systems backed by advanced hybrid engine technology enable complex activities like travel booking and reporting.

Paxes blends super-efficient travel management with HRMS integration options to improve the corporate travel program. Travel managers can configure travel policies by incorporating LTA details of employees to help them avail of tax benefits.

Leave Travel Allowance is a crucial part of income that helps reduce employee tax liability. One should ensure to know the company policy about how to calculate travel allowance before making full use of the benefits and claim travel allowances for tax exemption.

How To Calculate Travel Allowance FAQs

What is the percentage of travel allowance?

Travel allowance depends on company to company and different types of services used during travel. Generally it is 10%.

How much travel allowance is allowed in income tax?

Maximum conveyance allowance is equal to 19200. While LTA depends on the actual spent on the travel.

What is travel allowance in salary?

Fixed percentage of salary that is dedicated to work related travel of the employee.

What is the limit of Traveling allowance exemption?

The traveling allowance exemption limit is the actual amount spent on the journey.

How do I claim travel allowance on my taxes?

Keep accurate records, determine the nature of your travel allowance, calculate the allowable deduction/exemption, claim deduction/exemption in tax return, and keep supporting documents ready.

Can I carry forward the unclaimed LTA of a block year to the next block year?

No, you cannot carry it forward.

What expenses can be included under LTA?

Transportation expenses, accommodation expenses, sightseeing expenses, and food and beverage expenses.

What factors should be considered when calculating travel allowance?

When calculating travel allowances, consider factors like destination, duration, accommodation costs, meals, transportation, and incidental expenses. Also, account for your organization policies, tax regulations, and the purpose of the trip. Accurate record-keeping and expense receipts are crucial.

Is there a standard formula for calculating travel allowance?

There is not a universal standard formula for travel allowance, as it varies widely among organizations and regions. Some may use per diem rates, while others calculate expenses individually. Compliance with local tax laws and company policies typically guides the calculation method used.